Fianancial Reckkoning Day Surving the Soft Depression of the 21th Century

"History shows that people who save and invest grow and prosper, and the others deteriorate and collapse. As Financial Reckoning Day demonstrates, artificially low interest rates and rapid credit creation policies set by Alan Greenspan and the Federal Reserve caused the bubble in U.S. stocks of the late '90s. . . . Now, policies being pursued at the Fed are making the bubble worse. They are changing it from a stock market bubble to a consumption and housing bubble. And when those bubbles burst, it's going to be worse than the stock market bubble . .

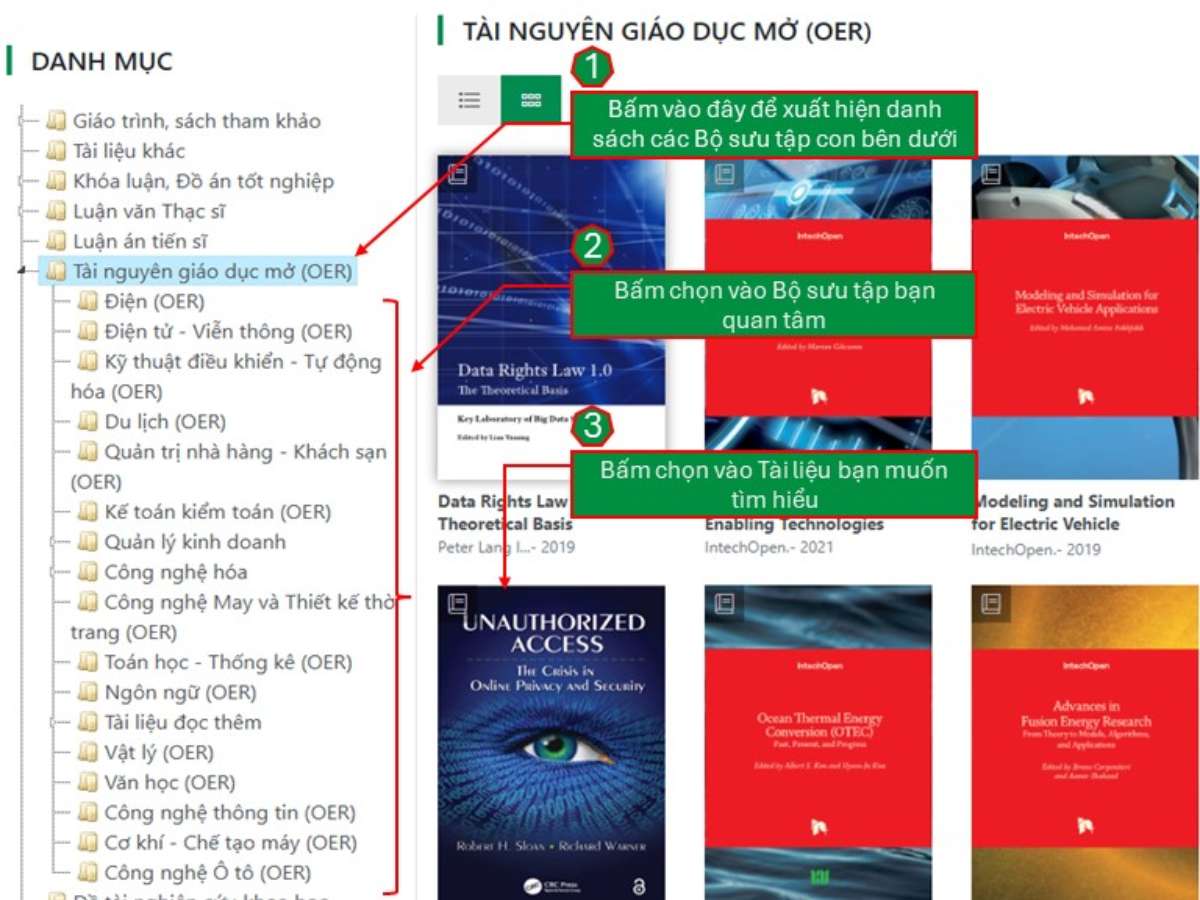

![[Coursera] Khóa học “Tìm hiểu các phương pháp nghiên cứu” của ĐH Luân Đôn](https://lic.haui.edu.vn/media/78/t78458.jpg)